The world's largest cryptocurrency

A climate compensated Bitcoin investment

Collaboration with ClimatePartner Sweden

1.49% annual management fee

Bitcoin, established in 2009, represents a groundbreaking development in financial technology. It is a rule-based monetary system with a fixed limit of 21 million units, ensuring its value over time. Currently, approximately 19.6 million Bitcoins have been mined, and it is expected that the last Bitcoin will be mined around the year 2140.

Unique to Bitcoin is its halving mechanism, where the number of new Bitcoins generated every ten minutes (currently 6.25 Bitcoin) is halved every four years. The next halving is scheduled for April 2024. This method is similar to how gold is mined, where the amount of new gold entering the market gradually decreases over time, contributing to its value and rarity. This process of deflationary pressure is a central aspect that compares Bitcoin to gold, highlighting its potential as a long-term store of value.

| Asset class | Last 12 months (%) | |

|---|---|---|

| Bitcoin | +103.99% |

| Nasdaq | +47.60% |

| OMX 30 | +4.81% |

| Gold | +7.10% |

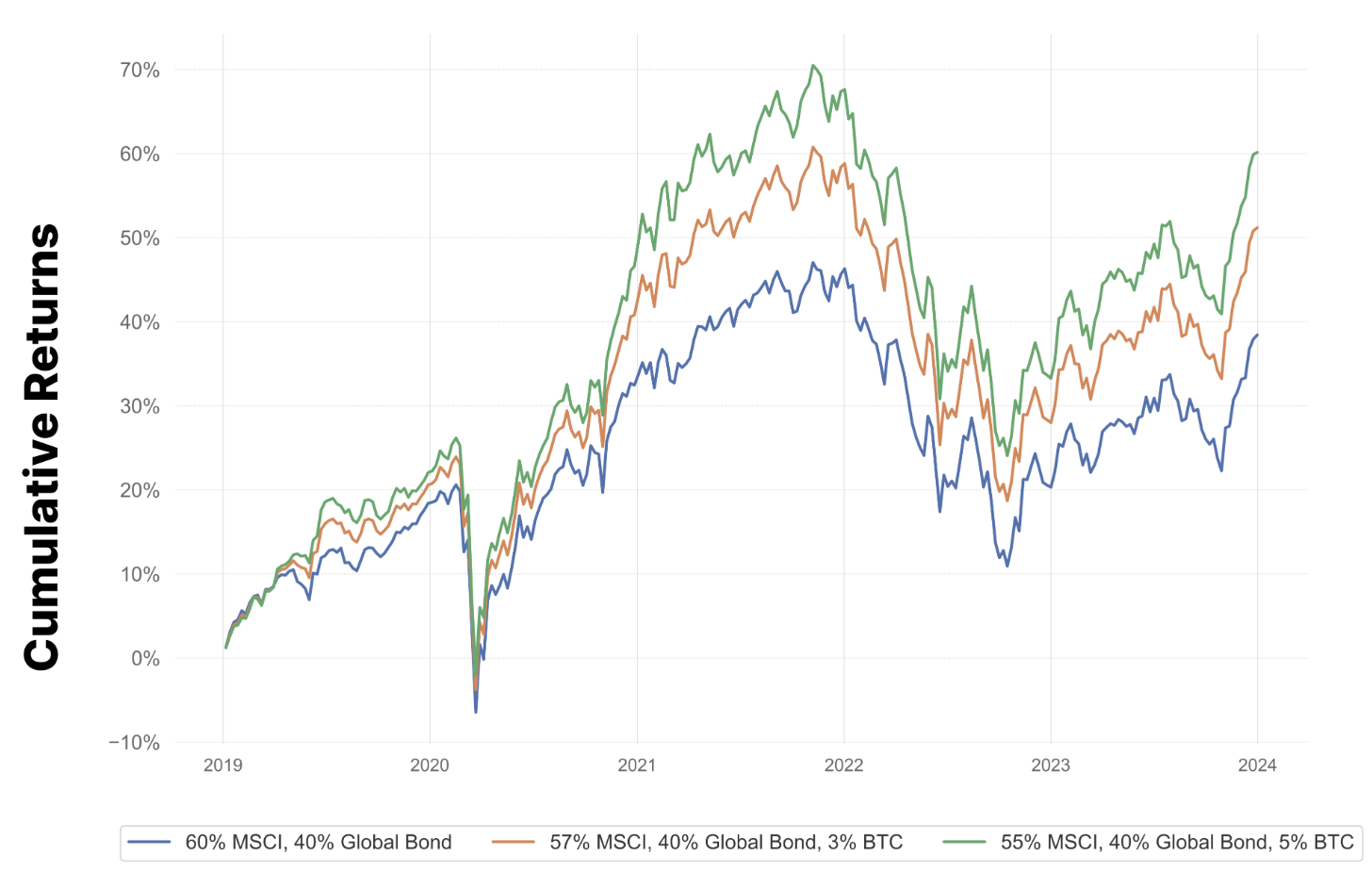

The depicted graph demonstrates the impact of allocating either 3% (depicted in orange) or 5% (depicted in green) to Bitcoin on the overall performance of a conventional portfolio. Allocating 3% or 5% to Bitcoin over a 5-year period (2019-2024) would significantly enhance the overall return of the total portfolio.

We believe that Bitcoin should constitute 1-5% of a portfolio and be positioned in the alternative investment section of a well-diversified portfolio.

The world's largest cryptocurrency

A carbon neutral Bitcoin investment

Collaboration with ClimatePartner Sweden

1.49% annual management fee

The world's second largest cryptocurrency

Staking for improved return

Non-custodial staking for increased security

1,40% annual management fee

Broad exposure to up to 10 leading cryptocurrencies

Rules-based index strategy

Monthly rebalancing to reflect current market conditions

1,95% annual management fee

Chainlink collaborates with world-leading financial institutions

Connects traditional finance with crypto

1.49% annual management fee

Connecting blockchains together

4% additional annual return through staking

Non-custodial staking for increased security

1.49% annual management fee

Layer 2 scaling solution for Ethereum

Enhances Ethereum's smart contract efficiency

1,95% annual management fee

Manages thousands of transactions per second

3% additional annual return through staking

Non-custodial staking for increased security

Lightning-fast transactions, minimal fees

2% extra annual return through staking

Non-custodial staking for increased security

10 Spot Bitcoin ETFs are approved by the SEC in the USA. Some of the world's largest asset managers, including BlackRock, with a total of $17.7 trillion in managed assets, have now launched Spot Bitcoin ETFs in the USA.

MiCA (“Market in Crypto Assets”) which is the first crypto regulation in the European Union, is being applied during 2024 which is an important regulatory progress for the whole crypto market.

The Bitcoin halving in 2024 is significant for the market as it reduces the creation of new Bitcoins, potentially leading to increased value per unit by creating higher demand as the supply diminishes.

Unlike many certificates available on the market, our Exchange-Traded Products (ETPs) are always 100% physically backed, which is crucial as it guarantees the value of each ETP.

This means that we store the corresponding cryptocurrency of equivalent value at our custodian Coinbase, in a so-called cold storage with institutional security level.

Virtune employs a Collateral Agent whose purpose is to protect and represent investors in our products. The cryptocurrencies held in cold storage (offline) at Coinbase are separate from Virtune's balance sheet.

Our product is 100% physically backed, meaning that we always store the corresponding cryptocurrency with our custodian Coinbase in an amount equal to at least 100% of the value of all our ETPs.

The products are always at least 100% physically backed with corresponding cryptocurrencies

Institutional security level through various security measures such as cold storage

Easily accessible through your bank or broker without the need of a separate account

Always liquid and traded directly during stock exchange opening hours as any stock

At Virtune, sustainability is a crucial factor for us, and we strive to align our business strategy with sustainability efforts. In a world where the digital economy is rapidly evolving, we are determined to lead the way in offering environmentally responsible and climate-compensated exchange traded crypto products.

Virtune's vision is clear: to revolutionize the crypto landscape by integrating sustainability and climate-related issues into every aspect of our business. We understand the pressing challenges of environmental impact and energy consumption associated with certain cryptocurrencies. That's why we have made it our mission not only to provide innovative and sophisticated crypto products but also to minimize the environmental footprint of our operations and products.

Virtune collaborates with ClimatePartner Sweden AB for our climate compensating efforts. We compensate annually to a value corresponding to a predetermined share of our total managed capital through investments in a diversified portfolio of projects within renewable energy, social impact and nature-based projects. This percentage of our total assets under management is reviewed annually and adjusted according to prevailing conditions. These projects are in line with the United Nations' 17 sustainability goals and meet, among other things, The Gold Standard and The Verified Carbon Standard.

Daniel Lundberg

CFO

Vilhelm Niklasson

Quantitative Analysis Advisor